Bitcoin and NFTs: Market Updates and Innovations

Subtitle: Blur Emerges as a Serious Competitor, Arbitrum Surpasses Ethereum, Coinbase Launches New Layer 2 Blockchain, and Hong Kong's New Plan for Retail Investors in Cryptocurrencies

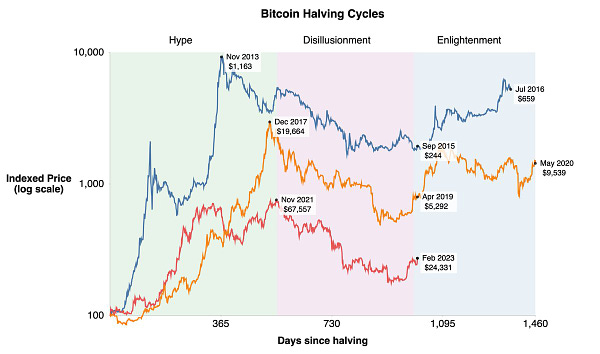

Bitcoin's price movements have been closely monitored by many, especially its performance in previous cycles. Despite experiencing long downtrends, Bitcoin has consistently rebounded in a positive direction throughout history. The current cycle is no exception, with Bitcoin following a pattern similar to previous cycles and staying on track with the halving cycle. Bitcoin saw a significant surge in 2018, leading up to 2019. As we emerge from a low bottom, Bitcoin is known to experience substantial growth. While there might be slight differences in Bitcoin's growth trajectory compared to two cycles ago when there was no institutional adoption or support from countries and its value was smaller, this recovery could still be significant.

NFTs

The NFT market has seen explosive growth recently, but many platforms have struggled to differentiate themselves from the pack. That's where Blur comes in. With its integration of professional trading tools and aggregators, Blur has revolutionized the NFT space by offering a unique platform that stands out.

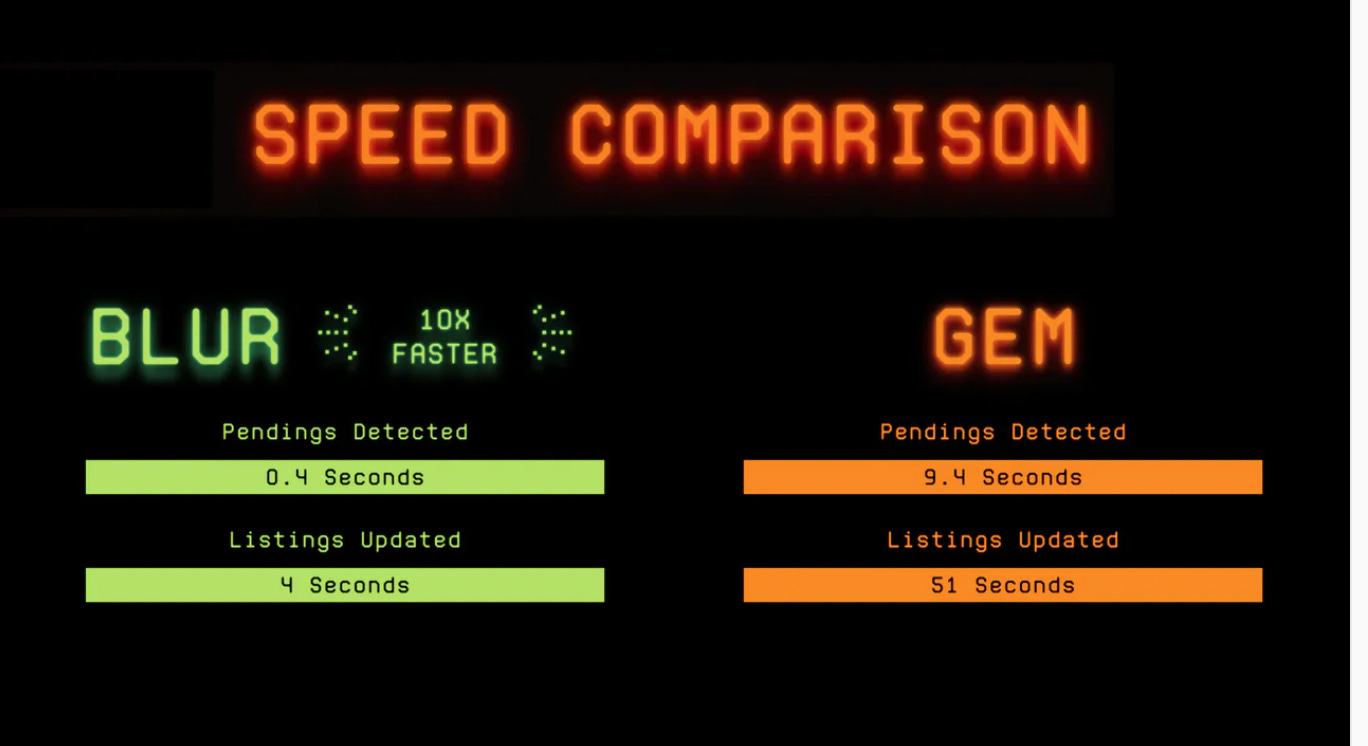

While Opensea has long dominated the NFT market, with a 70-90% market share, Blur has emerged as a serious competitor. With its focus on blue-chip NFTs and pro traders, Blur has positioned itself as the go-to platform for serious collectors and investors. And it's easy to see why: with lightning-fast speed, unmatched functionality, and a deep understanding of pro traders' needs, Blur has quickly become the platform of choice for many in the NFT space.

Blur is ten times faster than its nearest competitor, Gem when it comes to updating listing information. And its powerful suite of trading tools, including floor sweeping, P&L calculations, positions, address display, and batch orders, make it the ultimate platform for pro traders looking to maximize their profits and minimize risk. As the NFT market continues to evolve and grow, Blur is poised to lead the way with its innovative approach, unmatched speed, and functionality.

What’s Happening in the Space?

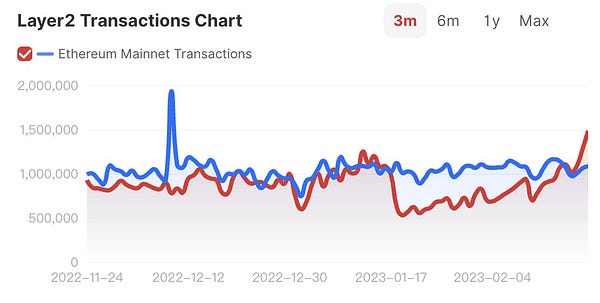

The Layer 2 network, Arbitrum, has recently achieved a remarkable achievement by surpassing Ethereum in daily transactions. With over 1 million daily transactions, Arbitrium has quickly climbed to become the fourth largest blockchain in terms of total value locked (TVL). The number of unique addresses on Arbitrum's network has hit an all-time high of about 2.95 million, indicating a surge in user activity. There is a lot of speculation around Arbitrium in anticipation early adopters could be rewarded with a token airdrop in the future.

Coinbase has recently launched a groundbreaking new layer 2 blockchain designed to serve as an on-ramp for Ethereum, Solana, and other leading platforms. The testnet of this cutting-edge blockchain, called "Base," was initiated by Coinbase on Thursday, marking a major milestone in decentralized applications. As a Layer 2 (L2) network, Base offers a user-friendly platform for developers to build and deploy dapps on the blockchain. Using innovative Optimism technology, Base provides a powerful and flexible foundation for building a wide range of decentralized applications. Despite the potential of this new platform, Coinbase has opted not to issue a new network token at this time.

Is Crypto in Hong Kong getting backed by Beijing?

Hong Kong is taking steps to allow retail investors to trade cryptocurrencies, specifically Bitcoin and Ethereum, as part of a new plan proposed by the Security and Futures Commission. Licensed exchanges must verify that their clients possess sufficient knowledge of virtual assets before allowing them to trade. The timing of this move is particularly interesting given the US government's ongoing indecision on crypto regulation and the emergence of new hubs for digital assets. Since China's crackdown on crypto trading, web 3 startups in the country have largely shifted their focus and market share elsewhere. With Hong Kong's more lenient regulatory environment for cryptocurrencies, some Chinese-founded web 3 companies may return to their home country. It remains to be seen whether Beijing will continue to sit on the sidelines as the rest of the world invests heavily in the web 3 space, but it's a complex scenario to imagine.

I hope you're all enjoying my crypto and digital asset newsletter! I'm eager to hear your thoughts on any subjects you'd like me to dive into over the next few weeks. Feel free to share your ideas with me!

Not Financial Advice

Please note that all opinions in my newsletter are strictly my own and should not be considered financial advice. It is important to conduct your own research and make your own investment decisions. Always consult a qualified financial advisor before making any investment decisions.